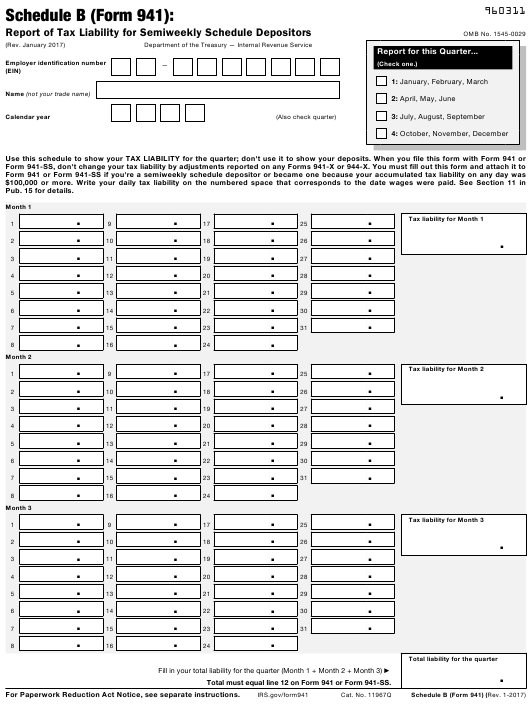

3rd Quarter 2025 941. If you fail to file a form 941 on or before due, it may result in a penalty of 5% of the unpaid tax amount for each month the return is late. Schedule b, report of tax liability for semiweekly schedule depositors;

Schedule b, report of tax liability for semiweekly schedule depositors; Learn filing essentials, get instructions, deadlines, mailing info, and more.

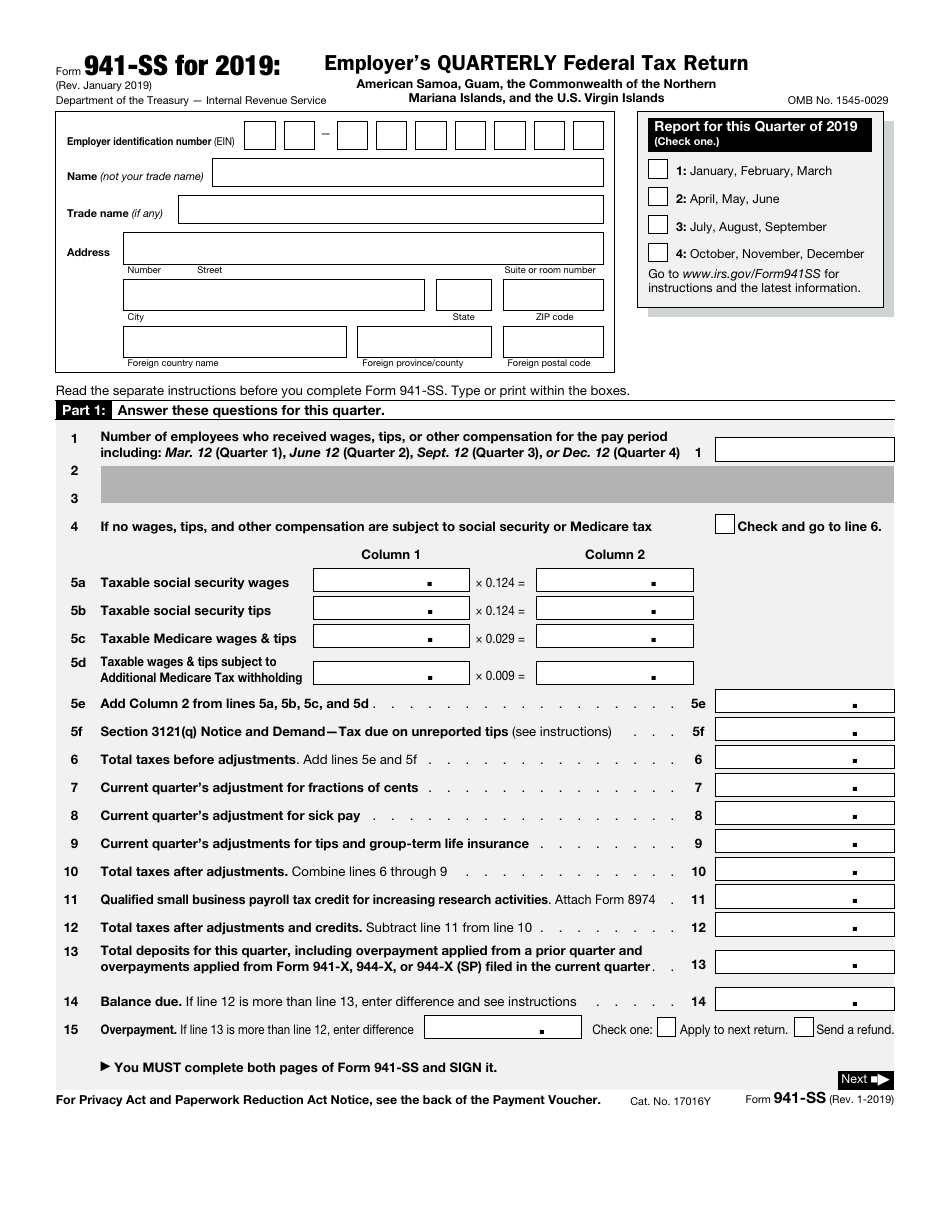

3rd Quarter 2025 941 Catlin Casandra, There are a few changes to form 941 that employers should be aware of before filing form 941.

941 Instructions 2025 Pdf Con Sarena, Tax year 2025 guide to the employer's quarterly federal tax form 941.

Irs Quarterly Payments 2025 Form Dena Lorrayne, The third quarter of 2025 is the first quarter that begins after rose co.

Irs Form 941 Schedule B Fillable 2025 Adey Loleta, The irs released the 2025 form 941, employer’s quarterly federal tax return;

GRADE 3 DAILY LESSON LOGS (Q3 WEEK 1) Dec. 913, 2025 DepEd Click, Tax year 2025 guide to the employer's quarterly federal tax form 941.

3rd Quarter 2025 941 Form Betta Sophie, Form 941 is a federal tax form used by employers to report wages paid to employees and the federal taxes withheld from those wages, including income tax, social security tax, and medicare tax.